by Chris Gilbert, Senior Economic Advisor, Energy Networks Australia

Oil prices went negative for the first time in history during April, with May future contracts for US West Texas Intermediate crude oil falling to never-before seen lows, dragging down Brent crude futures with them. Here, we take a look at some of the wider energy implications of massively reduced oil prices.

Flatlining industrial demand, fuelled by the COVID-induced US industry shut down, led to storage facilities reaching capacity and having nowhere to store oil.

In great news for hip pockets, this could eventually have the flow-on effect of reducing energy bills.

Liquefied Natural Gas (LNG) prices tend to follow Brent crude oil prices but with a lag of about three months.

If LNG exports from Australia fall in line with global LNG prices, use for domestic supply looks much more attractive. With more gas staying onshore, we might expect downward pressure on wholesale gas prices and a reduction in gas-powered electricity generation costs, which could also lead to lower electricity generation costs.

The extent to which cheaper natural gas prices influence electricity wholesale prices largely depends on how often gas generators running on cheaper natural gas can displace other, now more expensive forms of generation in the wholesale electricity market.

Lower wholesale gas and electricity prices will mean lower bills for customers as long as these savings are passed through to retail prices.

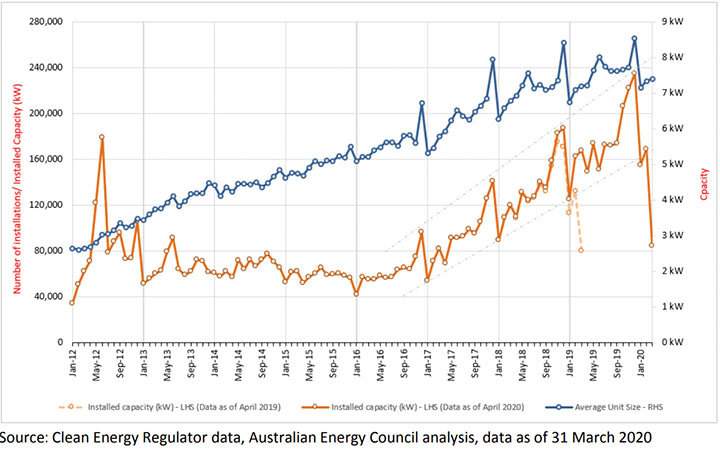

Figure 1. Monthly installations, installed solar PV capacity and average system size, January 2012 – Mar 2020 (Source: Clean Energy Regulator data, Australian Energy Council analysis).

DER impacted

The rapid descent in oil prices serves as an interesting example of how interlinked the energy market can be.

Falling wholesale electricity prices, from any oil price effects or simply lower demand, could, for example, even influence the path of investment in Distributed Energy Resources (DER).

If lower oil prices do lead to a fall in wholesale electricity costs and end-use electricity tariffs, the value of electricity produced and consumed by solar PV will fall, making it less likely that households and businesses will invest in DER.

Non-essential spending – particularly on large capital items – is likely to dry up and limit investment in DER.

DER investment is down, but the ability to produce and install DER technologies is also likely to have fallen as well.

DER equipment could become relatively more difficult to access, with some borders closed and supply chains disrupted. Additionally, qualified installation personnel may in some cases be unable to work due to COVID restrictions.

However, more households are working from home and are benefiting in the short term from self-consuming a higher proportion of electricity from their DER. Despite the incentive of better utilisation, working from home doesn’t seem to be a strong enough incentive to spur investments in DER, as new solar installations in March seem to have plummeted (though March installation data may still be trickling in).

DER take-up at risk?

While it’s clear DER uptake rates have fallen, the exact factors at play are opaque.

If the repercussions of COVID persist, it’s likely that the trajectory of DER uptake will be noticeably impacted.

The Australian Energy Market Operator (AEMO) produces a few different scenarios that attempt to model DER uptake in different economic, policy and technology conditions.

The ‘central’ scenario reflects current policy settings and technology trajectories, where the transition from fossil fuels to renewable generation is led mainly by market forces.

There are other upward and downward scenarios, for example the ‘step-change’ scenario, with aggressive decarbonisation targets and strong technology improvements, or the ‘slow change’ scenario, where economic conditions are challenging, investment is lower and living standards are protected over pursuing structural reform.

There’s no doubt that over the last couple of months there’s been a broad economic shift towards the ‘slow change’ scenario, but the scale and persistence of the shift remains to be seen.

We’ll have to wait until the dust settles before we have a better picture of how DER uptake is likely to track in the months and years ahead.